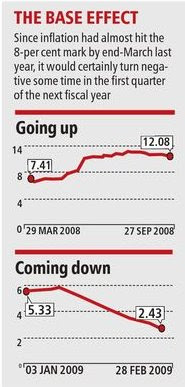

Goodbye inflation, hello deflation!

With

inflation already at an almost seven-year low of 2.43 per cent in

February, it’s apparent now there would certainly be a period of

negative inflation (or deflation) later this year resulting from the

high inflation base of the previous year. “It is reasonable to expect

deflation by April this year,” Siddhartha Sanyal, vice-president of

research at Edelweiss Securities said. Stressing that inflation had

almost hit the 8-per cent mark by end-March last year, Sanyal said

inflation would almost surely turn negative some time in the first

quarter of the next fiscal year.What is surprising now, however, is not

the imminence of deflation, but the possibility of negative inflation

persisting for a good six months. Sanyal, however, believes deflation

could easily last about six months corresponding to the long phase of

double-digit inflation last year set off by the hike in petrol and

diesel prices by the government. “Deflation could easily last through

the first half of the next fiscal with a turnaround in the second

half,” he said.The wholesale price index (WPI), the main index used to

measure inflation, stood at 227.8 point in April last year and rose

sharply over the next few months to peak at 241.7 in early September.

Correspondingly, the WPI currently stands at 227.7 as per provisional

figures issued by the department of industrial policy and promotion and

has been falling more or less continuously since September. If it

continues the trend, the index levels could go significantly lower than

those in the corresponding period last year leading to sustained

deflation.Negative inflation, which usually has severe implications for

the economy, may not affect the Indian economy in the long run.

“Looking at inflation in India over a one-year or two-year window, it

would still come out to around 4-5 per cent,” said Sanyal. Adding that

prices of a lot of commodities like food articles and certain other

industrial inputs are still rising gradually, he said deflation is not

a grave concern for India since it is largely technical deflation

rather than a structural problem.

|

|