Early Investor , Smart Investor

You

are 25 , and want to retire at 60 , after 35 yrs . You earn anything

more than 10k+ , and can save more than 2k per month for investing if

you wish . You might be earning 30k or 60k or whatever , but i am

considering an average urban Indian who is earning 10k or 12k or

anything like that and can save more than 2k per month .

You

are 25 , and want to retire at 60 , after 35 yrs . You earn anything

more than 10k+ , and can save more than 2k per month for investing if

you wish . You might be earning 30k or 60k or whatever , but i am

considering an average urban Indian who is earning 10k or 12k or

anything like that and can save more than 2k per month .Now , What would you like to do ?

Choice 1 : Start now and invest total of 8.4 Lacs (8,40,000) distributed in a span of 35 yrs (till your retirement).

Choice 2 : Or after 15 yrs , when your salary is increased and you have good money , then Invest 72 lacs (72,00,000) , in a span of 20 yrs (start when you are age 40) .

In Choice 1 you will have to invest 2,000 per month for 35 yrs , so you invest total of 2000 * 12 * 35 = 8,40,000 (8.4 lacs)

In Choice 2 : You invest 30,000 per month for 20 yrs , so you invest total of 30000 * 12 * 20 = 72,00,000 (72 Lacs) .

In choice 1 you pay less than 12% of what you pay in choice 2 . I am sure that you must have got a hint by now that which choice will lead you to generate more money , But it has to have some assumptions .

Choice 1 : You are investing for 35 yrs . What is the return we should expect in this case , In last 29 yrs of history , Indian Equities have returned 17.5% , So we will expect same return of 17.5% , but i am expecting it to be much more .

Choice 2 : In this case you are investing for 20 yrs , we can easily expect close to 15% returns in this case .

Lets reveal the secret and see the numbers now.

Choice 1 : You pay 2000 per month for 35 yrs @17.5% CAGR , total amount at the end : 5.9 Crores

Choice 2 : You pay 30000 per month for 20 yrs @15% CAGR , total amount at the end : 4.5 Crores

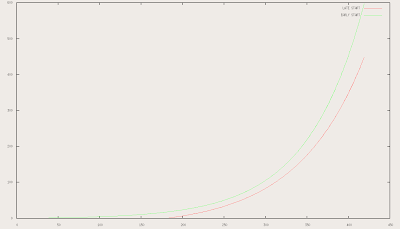

The graph below shows how the money increases with each choice (Early start and Late Start , I spent 2 hrs figuring out how to plot this graph using gnuplot (linux command for plotting graphs ... man , it took me so much time to just do this)

CLICK ON THE GRAPH TO ENLARGE ...

Now , What is the Learning ?

Now , What is the Learning ? This article is for people who think they don't earn much money to invest , There are many who earn 7k , 10k or 15k per month and there are many who earn 30k,40k , 50k per month . People who earn less often think what can 1k per month do , they fail to see what will happen in long term , they do not appreciate power of compounding .

Wealth is generated by people who invest smartly and with discipline , not who just earn lots of money .

Where to invest ?

If you are a regular reader of this blog , then you know the answer , if you don't, then let me tell you , Its Diversified Equity Mutual funds , take a SIP and invest small sum of money every month , The more you can contribute in the start , the lesser you need to invest in later years of your life .

For example, If you can invest 4000 per month (instead of 2,000) in the starting years of your career like 10 yrs , then you can stop investing for rest of 25 yrs and still generate more wealth (around 7 crore) ,considering same interest of return

Is it practical to put 4k for starting 10 years and then leave it for 25 yrs , May be NOT !! .. People tend to take the money out when they require it and never give compounding any chance to show its strength . But if people leave it , they will see how amazing and powerful it is .

Why do you believe me and whatever i write here ?

Ans : You never believe me or for that matter any one when it comes to investing and your money , you just choose to learn from me and check the authenticity of what i say , you can read what i tell you and what i write , Ask your self if there is any logic behind anything or not .

When i say expect 17.5% CAGR return in 35 yrs time duration , Its because equity outperforms every other asset class in long , and it has happened over centuries .

When i say that if you invest X every month @r % return for t years, you will get A amount at the end , you should go and check using your own calculations to see if the figures are right or not .

For people who are new to Mutual funds and don't how to choose it can read my earlier post : http://www.jagoinvestor.com/2009/01/what-to-look-for-while-choosing-mutual.html

Be a early Investor , be a smart Investor .

Personal notes

ok ,I am done with my post of the day . I should take my time off now .

Yesterday i went for a Trek to Madhugiri some 40-50 km from Bangalore in Tumkur district , interested people can choose to look at some pics i uploaded at http://www.flickr.com/photos/manish_chauhan/sets/72157613257560390/detail/

btw , there is a group called BMC (Bangalore mountainering Club) which organises these events , anyone who is without a group or with a group can come for the events , Just register for the event and go for the events . See there site for more : http://www.bmcindia.org/

|

|