Financial Investment Grounds And Fundamental Pick For Essar Oil

“The safe way to double your money is to fold it over once and put it in your pocket “

Essar Oil, part of Ruia family's Essar group is engaged in exploration and production (E&P), refining and marketing of oil and oil related products. With the production capacity of 14 MMTPA oil refining it has also 1,635 retail outlets of fuel station across the country. In E&P business it is producing about 35,000 scmd from 33 production wells and also has 2C contingent resources of 148 mmboe. Globally it also has refining capacity 300,000 bpsd and also having a controlling stake of 50% stake in Kenya Petroleum Refineries Ltd's 80,000-bpsd refinery.

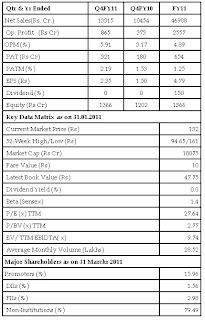

FINANCIALS: Since FY06 to FY11 the Net Sales of the Essar oil has grown at CAGR of 136% while on account of high cost raw materials it beard losses up to FY09 but now in FY11 the Net Sales jumped by 28.7%% to Rs 46988 crore over FY10 and Operating Profit rose by 114% to Rs 2557 crore, the PAT for the same period also surged 2155% to Rs 654 crore. The OPM & PATM of Essar oil for the same period stood at 5.44% & 1.25% respectively. In Q4FY11 the Net Sales surged by 27.4%, Operating Profit & PAT also grew by 132% & 78% respectively.

INVESTMENT GROUNDS Industry Outline After facing an economic slowdown in FY09 the worldwide demand for oil is now on its peak level and even in 2011 the demand for oil has suppressed the highest ever demand of 2010, the global demand for oil in 2010 was 87.81 mmbpd while in 2011 it touched 89.35 mmbpd. The mass consumption is coming from Asian region (0.78), Middle East (0.25) and Latin America (0.20) mmbpd. Despite increase in consumption of Oil & Gas world wide the per capita oil consumption in India is one of the lowest among major countries. In 2010 the annual per capita oil consumption in India was 0.9 barrels/person while in other developing countries like Russia, Brazil and China it stood at 7.5, 4.4 and 2.3 barrels/person in the same period. However, USA and European countries still have the highest per capita oil consumption, In USA it is around 19.4 and in EU it 9.7 barrels/person. The situation is almost the same for the consumption of gas. However, the demand for petroleum products in India is growing at fast rate the demand for oil grew at 6.5% in FY11 from 1.4% in FY06 and demand for Gasoline also increased from 4.8% to 10.9% for the same period. So Anyone can start trading oil with online trading apps like Oil Profit - to make money on oil.

Capacity Expansion will help to improve the GRM… Essar oil is enhancing the production capacity of existing refining up to 18 MMTPA from current capacity of 14 MMTPA. The increased production is expected to start from mid Q4 CY11. Essar Oil is also ready to optimize the cost of its six refinery units which is scheduled to be completed by September 2012. This optimization will further enhance its production capacity up to 20 MMTPA and also increase the complexity (GRM) of the company up to US$11.8 from current US$6.1. Further under phase-II Plan company has also targeted to achieve the capacity up to 38 MMTPA. After achieving this much of capacity Essar oil will enjoy the complexity of US$12.8.

Expanding Presence in Retailing by adding more Outlets… Essar oil is currently running 1,635 retail outlets across the country and to increase the presence in oil marketing segment it aimed to extend 5000 outlets across the country, currently 254 outlets in various stages of construction. Recently company has commissioned two CNG stations in association with Sabarmati & GSPC and also focusing on ALPG & CNG pumps through tie Aegis, Sabarmati Gas and GAIL Gas respectively. Besides this, company is also focusing on revenue from non fuel business and formed alliances with various Govt agencies to for that.

Exploration and Production Business also rapidly growing… In Exploration and Production segment Essar oil has also presence through diverse portfolio of offshore and onshore oil & gas blocks. Currently it is producing about 35,000 scmd from 33 production wells and also got the approval from MoPNG for drilling another 500 production wells in Raniganj. In Raniganj to start commercial production the construction of 48-km gas evacuation pipeline from Raniganj to Durgapur has also been completed. Company has also signed contracts for 4 Indian Coal Bed Methane blocks with estimated resources of over 7.6 tcf.

About Author:Mansukh brings to you the most updated monthly magazine which will not only help you in understanding online share market but will also help you do your own Analysis conveniently and smartly. Mansukh is providing derivative trading and Fundamental Pick for last 15 years. For all the latest happening of the market please visit http://moneysukh.com

|

|