INDIAN ECONOMY- GROWTH MAY BE TAPPED BY INFLATION, SECTORS SPECIFIC MOVE

Higher input costs did not restrict Indian manufacturers from improving performance during the year ending March 31. However, risks remain which will put pressure on their profit margins in the coming year, said a survey by industry body CII. According to the chamber's Ascon survey , 41 out of 121 sectors in the survey are estimated to grow at 20% or more in the current financial year, compared to 34 sectors that had reported such growth during 2009-10. The top performers include air conditioners, tractors, fertilisers, construction equipment, tyres, and vehicles among others.

Higher input costs did not restrict Indian manufacturers from improving performance during the year ending March 31. However, risks remain which will put pressure on their profit margins in the coming year, said a survey by industry body CII. According to the chamber's Ascon survey , 41 out of 121 sectors in the survey are estimated to grow at 20% or more in the current financial year, compared to 34 sectors that had reported such growth during 2009-10. The top performers include air conditioners, tractors, fertilisers, construction equipment, tyres, and vehicles among others.

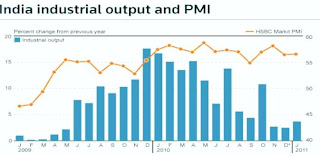

Although the total percentage of sectors reporting double digit growth has increased marginally this fiscal, just a handful of sectors reported lower production compared to one in every five that shrunk in size for the year ended March 2010. Sectors such as tea, asbestos cement, and edible oils are among those that are expected to report negative growth. Sectors that are projected to record high growth (10-20%) for the year ending March'11 include utility vehicles, natural gas, crude oil, power transformers, energy meters, home and personal care products, automation industry, alcoholic beverages and biscuits. As many as 49 sectors, including caustic soda, soda ash, cement, refinery, steel, rubber goods and ceramics, may clock up to 10% growth. During 2009-10, less than half such sectors recorded moderate or single digit growth. India's core sector, comprising of six infrastructure industries, has registered growth of 6.8% in the month of February, raising hopes that the performance of the overall index of industrial production (IIP) will also be better in the month under review. The core sector has a weight of 26.7% in the overall IIP and includes crude oil, petroleum refinery, coal, electricity, cement and steel.

Looking at the individual performance, crude oil with a weight of 4.17% in the IIP recorded the best show with a strong growth of 12.2% in February 2011 against a growth rate of 4.0% in February 2010. Cumulative production of crude production grew 11.9% during AprilFebruary period of current financial year against 0.3% during the same period of the last fiscal. Cement and steel were two better performing sectors indicating that infra activity was finally picking up in country after showing significant slowdown in second half of last year. Cement production (weight of 1.99% in IIP) recorded a growth of 6.5% in the month under review as compared with 7.9% in the same month a year ago. production of finished steel (weight of 5.13 per cent in IIP) on the other hand recorded a growth of 11.5% in February 2011 against a negative (-) 0.2% in February 2010.The cumulative growth in the two industries stands respectively at 4.3% and 8.1%.

Bombay Stock Exchange Realty turned out to be the best sectorial index on the bourses, gaining 8.99% over the past one week. The market saw a change in mood with stocks moving upward. The week saw legendary investor Warren Buffett's maiden visit to India in which he recognized India as an investment destination. The government made its contribution by moving the bills to amend banking sector laws and implementation of goods and service tax. The proposed changes in voting rights in banks ensured that the banking stocks make it to investors' radar. "Traders will keenly watch 5800 level on Nifty. Some profit-taking is expected ahead of expiry of March derivative series. We believe the markets recovery is more likely to pause unless investors follow up last week's unwinding of short positions with delivery-based buying. Moreover the market looks overbought in the short term. The focus in the coming week will be on the extent of rollover in March derivatives contracts to the next month before expiry and developments in the Eurozone.

Read more about Mansukh Monthly Magazine Indian Economy Report

About Author:

Mansukh brings to you the most updated monthly magazine which will not only help you in understanding online share market but will also help you in doing online stock market trading conveniently and smartly. For all the latest happening of Share market trading, visit http://moneysukh.com. Related Post about Indian Economy

|

|