THINGS TO REMEMBER WHILE SHORT SELLING

Betting on rising stocks always deemed to be a profitable business from the point of view of trading or investing but have you ever being thought that you can also earn or gain profits in short term while stock goes down. Yes it is true that you can also earn and you could see your portfolio increase in value during a bear market too? Many investors make money on a decline in an individual stock or during a bear market only with the help of using an investing technique called short selling. Short selling is not complex but the concepts of short selling are not so easy to understand, especially for investors. Generally investors buy stocks and hold it until it appreciates and make profit when it rises, while short selling is opposite of that, in shorting stocks investors make money only when a shorted security falls in value. However, short selling involves many unique risks and pitfalls because mechanisms of short selling are relatively complicated compared to normal transaction, so it is very important to understand how the whole process works before you get involved.

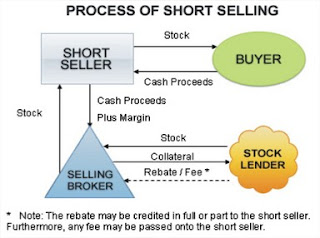

What is Short Selling? Actually when an investor goes long on an investment, it means that he or she has bought a stock believing its price will rise in the future. Conversely, when an investor goes short he or she is anticipating a decrease in share price therefore “Short selling is the selling of a stock that the seller does not own. More specifically, a short selling means the sale of a security or any individual stock that is not owned by the seller at that point of time, but he promises to deliver it at time of delivery is called short selling”.

Reasons to Short Usually there are two reasons behind the short selling, one used either for speculation or other for hedging. Let us discuss that where short selling used to speculate and where to hedge and also what are the restrictions to be followed while shorting stocks.

Speculation: Despite the negative perception on short selling speculation is done while watching the fluctuations in the Indian stock market in order to quickly make a big profit of high-risk investments. However, speculation involves a calculated assessment of the markets and taking risks where the odds appear to be in your favor. Actually speculators can assume a high loss if they use the wrong strategies at the wrong time, but they can also see high rewards if they speculated correctly.

Hedging: Short selling is also used by most of investor for Hedging. Hedging involves taking an offsetting position in a derivative in order to balance any gains and losses to the underlying asset. Hedging can be a benefit because you're insuring your stock against risk, but it can also be expensive and a basis risk can occur. The majority of investors use shorts to hedge. This means they are protecting other long positions with offsetting short positions.

Restrictions: However, short selling is done whether for speculation or for hedging but there are certain restrictions have to be followed by the investors. The main restriction of short selling is that you can place order within specified size, price and type of stocks in which you can short. For example, penny stocks cannot be sold short, and most short sales need to be done in round lots. There are certain restrictions placed to prevent the manipulation of stock prices.

Risk Involved in Short Selling Short selling is good to make profits in short term but short selling is also very risky bet because there are some unique risks entails like it is a pure gambling the losses can be infinite. Short selling can also make you bankrupt because money used might be from borrowings and short selling required to submit margin money with the broker. Lastly, short selling also works when it has been done with right timing because even selection of asset for short selling correct but if the timing is not suitable you will not be successful.

Conclusion: In a brief, short selling sale means an investor borrows shares, sells them and must eventually return the same shares (cover). Profit (or loss) is made on the difference between the prices at which the shares are borrowed compared to when they are returned. An investor makes money only when a shorted security falls in value. In fact short selling can be also used for adding some more profits to your portfolio in downside or bearish market. This is suitable if it fits with your risk tolerance and investing style. Short selling provides a sizable opportunity with a hefty dose of risk. We hope this tutorial has enabled you to understand whether it's something you would like to pursue from the short selling.

About Author:- Mansukh brings to you the most updated monthly magazine which will not only help you in understanding online share market but will also help you do your own Analysis conveniently and smartly. Mansukh is providing derivative trading and Fundamental Pick for last 15 years. For all the latest happening of the market please visit http://moneysukh.com

|

|