GLOBAL ECONOMY - CHINA WILL OUTSHINE THE US IN NEXT 10-12 YEARS

“Every morning I get up and look through the Forbes list of the richest people in America. If I'm not there, I go to work”

“Every morning I get up and look through the Forbes list of the richest people in America. If I'm not there, I go to work”

For the first time, the international organization has set a date for the evolution when the “Age of America” will finish and the US economy will be leaving behind by that of China. According to the latest IMF official forecasts, China's economy will outshine that of America in real terms up to 2016-2017 — just five to six years from now. And it's a lot closer than you may think. It endow with a painful context for the budget wrangling taking place in Washington right now. It hoists massive questions about what the international security system is going to give the impression of being like in just a handful of years. And it casts a deepening blur over both the U.S. dollar and the gigantic Treasury market, which have been buttress up for decades by their privileged status as the liabilities of the world's hegemonic power.

In addition to comparing the two countries based on exchange rates, the IMF analysis also looked to the true, real-terms picture of the economies using “purchasing power parities.” That compares what people earn and spend in real terms in their domestic economies. Under PPP, the Chinese economy will expand from $11.2 trillion this year to $19 trillion in 2016. Meanwhile the size of the U.S. economy will rise from $15.2 trillion to $18.8 trillion. That would take America's share of the world output down to 17.7%, the lowest in modern times. China's would reach 18%, and rising. Just 10 years ago, the U.S. economy was three times the size of China's. Naturally, all forecasts are fallible. Time and chance happen to them all. The actual date when China surpasses the U.S. might come even earlier than the IMF predicts, or somewhat later. If the great Chinese juggernaut blows a tire, as a growing number fear it might, it could even delay things by several years. But the outcome is scarcely in doubt.

FED CUTS ECONOMY OUTLOOK: The Federal Reserve Chairman Ben S. Bernanke stated on Wednesday that the US economy still requires monetary support and the Fed will end its $600 billion bond-buying program through June, indicating that the central bank is in no rush to scale back its support for the U.S. economy and will keep its benchmark interest rate near zero for an extended period'. At the first post-policy meeting press conference in the Fed's 97-year history, Bernanke tried to demonstrate the central bank as a dependable custodian of the US recovery as the bank begins to retreat from emergency measures.

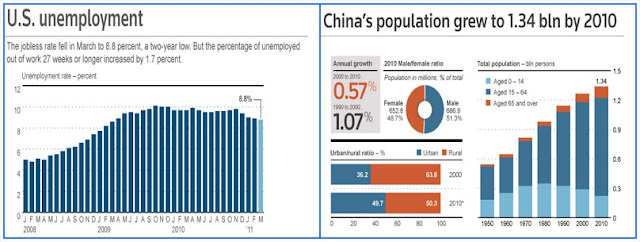

But amid relatively higher unemployment rate, a declining housing market and tepid growth, Wednesday's move was far from a full-blown move back from pre-crisis policies. The Fed shielded its ultra-accommodative policy by highlighting that although the labor market is healing, the housing sector remains depressed and the recent surge in energy prices will likely prove transitory. As far as unemployment rate is concerned, it expected to be in a range of 8.4%-8.7% for the calendar year which is upgraded from the 8.8%-9.0% range forecast in January.

The Fed also went ahead to not only lowering its economy outlook for 2011 due to sluggish first quarter growth on the back of adverse inflationary implications of soaring energy costs but the central bank also raised its forecast for inflation. The central bank has cut GDP expansion forecasts to 3.1%-3.3% from the previous outlook of 3.4%-3.9% for the year 2011 and the annual inflation is expected to swell by 2.1%-2.8% compared to January's expected range of 1.3%-1.7%.

About Author: Mansukh brings to you the most updated monthly magazine which will not only help you in understanding online equity trading but will also help you in doing online stock market trading conveniently and smartly. For all the latest happening of Share market trading, visit http://moneysukh.com

Read more about Mansukh Monthly Magazine report on Indian Stock market.

|

|