Nifty 50 Sensex From The Desk Of Research

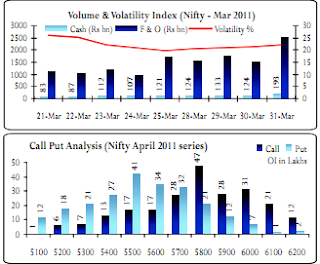

Indian frontline indices went through a rollercoaster ride on the settlement day of March series futures and options contracts as sentiments turned highly volatile in the second half of the session. The seven successive days of winning streak got extended for yet another day, thanks to the late short covering rally after the indices drifted to the red terrain on the back of hefty position squaring in rate sensitive and healthcare counters . The rebound in international crude prices by around a percent on the back of the ongoing turbul ences in Libya and neighboring nations too weighed on the local sentiments.

However , the rally in software and technology stocks capped the downside risks for the markets while the ease in inflation numbers to single digits during the week-ended March 19 after showing an unexpected increase in the previous week also supported the investor mood. The NSE's 50share broadly followed index Nifty, settled a tad below the crucial 5,850 support level, after surging around a percent while Bombay stock Exchange's Sensitive Index, or Sensex garnered over one hundred fifty points and closed just below the psychological 19,450 level. In the broader markets especially the mid cap stocks after a tremendous rally in last session showed some sign of fatigue but managed to hold in green. The BSE's Midcap and Smallcap indices went home with trivial gains of 0.29% and 0.21% pectively, underperforming their larger peers by quite a margin. On the sectoral front, The IT pocket grabbed the top gainer's position after garnering 1.92% on hopes that upbeat results and outlooks last week from global technology majors Oracle Corp and Accenture bode well for resurgence in tech spending.

The paper stocks continued to remain in jubilant mood while AP Paper Mills once again got locked in upper circuit other paper stocks too traded higher. On the other hand, the Banking sector languished at the bottom of the table after slipping 0.70% as majors like SBI and Indusind Bank plummeted 3.19% and 4.87% respectively..Among most active underlyings SBI witnessed a contraction of 13.08% in the March month futures contract, followed by Reliance which saw a contraction of 7.05% of OI in the near month contract. Tata steel witnessed an addition of 0.50% in the near-month futures and Tata Motors witnessed an addition of 14.21% in the near month futures contract . Meanwhile, the government is set to release a revised FDI policy circular later in the day hoping to attract greater amount of foreign funds in the next financial year beginning April 1. Among other modifications, the third edition of the Consolidated FDI Policy Circular (CFPC) may contain guidelines on domestic companies issuing shares to foreign entities for considerations other than cash, a move aimed at checking possible misuse of FDI policy to engage in money laundering.

At current juncture we expect the same scenario in the upcoming sessions though possibility of profit booking around 5875-5885 couldn't be rule out. Any closing above this level may generate another 250-300 pts rally and we might see 6070-6080 in the next series. On the flip side any negative outcome from global side particularly from Middle East Asia may dampens the current euphoria. Technically too spot index rallied from last 8 consecutive sessions. Therefore ossibility of minor retracement near to 5550-5570 could be on higher side however any correction should be used to create fresh long positions.

About Author:

Mansukh brings to you the most updated monthly magazine which will not only help you in understanding online share market but will also help you in doing online stock market trading conveniently and smartly. For all the latest happening of Share market trading, visit www.moneysukh.com.

|

|